From the video:

Are you a resident or citizen of India, and are wondering if you can purchase land in the US? The short answer is: yes you can! In this video, Felicia discusses an Indian guide to investing in US land.

This post is not going to cover how to buy houses, residential buildings, commercial buildings or otherwise. We are strictly talking about land here!

Can an Indian Citizen Buy Property in the USA?

Yes, Indians can buy land in the U.S.!

The good news is, if you’re paying cash for a property, that’s all you need. That’s right – no citizenship is required to purchase land for cash in the US. There are no citizenship requirement for real estate sales in the USA, any non-US citizens can buy any property. Anyone may purchase and own property in the United States, regardless of citizenship. There are no laws restricting a person from buying a property in the USA.

Does Buying Land in the US Grant Me Citizenship?

No, sorry. We get this question a lot from our foreign clients. Unfortunately, buying land in the US does not grant you citizenship, nor does it give you a legal right to live here. Investing in US real estate doesn’t automatically put you on a path to citizenship.

Immigration in the US is more strictly regulated than foreign investment. Since the signing of the Patriot Act in 2001, the rules to enter the US have become much more disciplined.

We are not immigration experts – if you are trying to figure out how your immigration plans aligns with your real estate investment plan, you should seek out the advice of an immigration lawyer to help you.

How Much US Real Estate is Bought by Indians Every Year?

It’s not a secret that the United States has long been a desirable destination for foreign real estate buyers. It offers world-class infrastructure, access to some of the best educational institutions in the world, and a very comfortable standard of living.

Global foreign travel and investment obviously shrank in 2020 as the world went into lockdown mode. We saw the dollar volume of US purchases by foreign buyers decrease by 27% during April 2020–March 2021. Even with that decrease, there was still $54.4 billion dollars of purchases made by foreign buyers.

India makes up 4% of all international American real property investments (totalling $3.1 billion dollars). America is still viewed as one of the better international opportunities to provide the best stable and secure real estate investment as well as the best possible opportunity to grow capital. It’s important to note here – buying land in the US does not make you a citizen.

Major US Destinations for Foreign Buyers from India

Where can Indians buy property in the United States? Location is totally subjective. It very much depends on what you want to use the property for. Is your goal long-term sit and hold? You need to make sure you do your research and check paths of growth of nearby cities. You should also look into whether the state is growing economically and in population.

Even though location is subjective, there are some locations that are popular with foreign buyers from India.

Per the NRA, California is the most popular state for foreign buyers from India by a long shot, at 40%. Next up are Texas, then we have Florida, Missouri, and Maryland.

Missouri is a surprising one here. California, Texas and Florida make sense because they’re popular states, they have good population and economic growth. Right now in the US there’s an exodus of people from California and they’re landing in places like Texas, Florida, Arizona, and Nevada. I wouldn’t be surprised if that trend pops up in international investment as well. We might see more interest from foreign buyers in India purchasing more land in Florida as a result.

How To Buy Property In the USA From India?

If you’re going to purchase a piece of land with cash, that’s all you need! Make sure that the person selling you the property is legit, and can answer all your due diligence questions.

If you’re buying a property through our company, Compass Land USA, we’ll walk you through our safe and easy process for buying one of our properties for cash.

Can Indians qualify for a mortgage in the US?

Yes, Indians can apply for a mortgage in the USA even without a US credit history. However, you should know that getting a mortgage for a land purchase can be extremely difficult. It’s a challenge even for US citizens and residents.

If you’re looking to get a conventional loan from an American bank, you’re going to face a much more difficult process. If you’re living abroad, you can expect to come up with 50% down payment for the property. If you’re living in the US, you’re going to face a lot of questions and the bank’s decisions could be based on whether or not you are a citizen or green card holder. This is not going to be an easy route.

What’s the easiest way for Indian citizens to buy land in the US?

The easiest way for you to buy land in the US as someone living in India is with cash. Pay for the property in full, the title transfers to you immediately, done deal.

If you really can’t come up with the cash and you don’t live in the US, the next best thing for you to do is to owner finance. You can try to do this through the company you are buying property from.

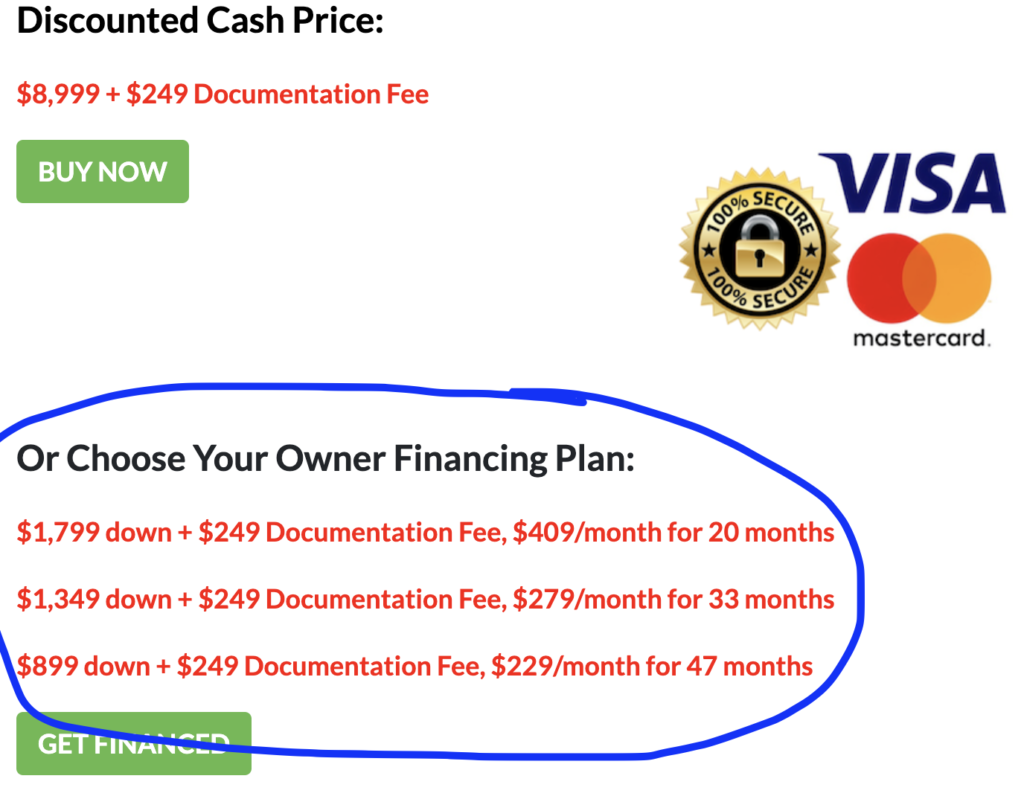

At Compass Land USA we offer owner finance on almost all our properties. There are normally 3 plans to choose from.

We don’t require credit checks, there are no prepayment penalties. You can learn more about our owner financing process here.

Note: We do not offer financing for other seller’s properties. We only offer owner financing for properties that we are selling.

Steps Involved in the US Land Buying Process for an Indian National

- Find your perfect property (you can do this easily online – no plane ticket required)

- Complete your due diligence steps (we have a free DD checklist you can refer to for help)

- Agree on a purchase price

- Arrange for the money needed to complete the transaction OR speak with the seller about owner financing

- Sign a Purchase Agreement

- Send payment and receive the deed to your new property!

At Compass Land USA we have an easy and safe process for buying land with cash and with owner financing.

How Long does the Property Purchase Process take in the US?

If you are closing through a title company (which we would recommend if you are an Indian NRA (nonresident alien) you can expect 30-60 days to close your land purchase.

If you are closing directly with the seller, it shouldn’t take more than 10 business days.

How long can you stay in the U.S. if you own property?

Solely based on buying a house in the USA, you are not granted any additional perks like acquiring residency. Once you have entered the USA on a Visitor/Business (B1/B2 Visa), you can stay up to six months. Other visa statuses have different stay durations.

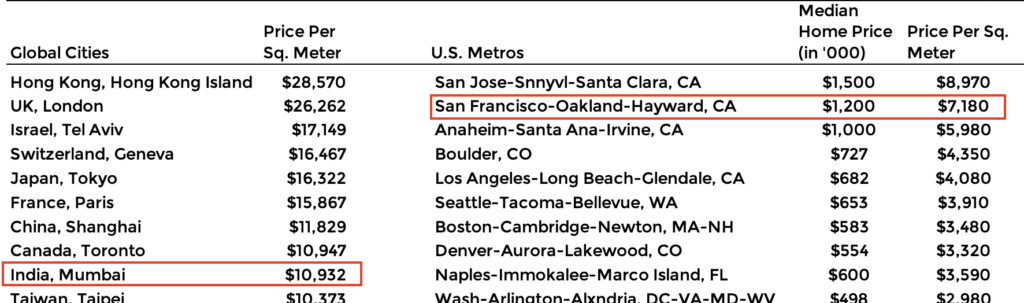

How does property price in USA compare to India?

On a global scale, US property prices are lower than others. Even in an expensive US city like San Francisco, the price per square meter is $3,700 less than in Mumbai. This data is for residential properties, but the trend for land should be quite similar if not the same.

If you are an Indian national looking to invest internationally, the US might be a great option for you. You can get a better bang for your buck compared to some other countries.

Tax Implications for Indians Buying Property in the USA

We are not tax experts and cannot give you tax advice. You should seek out the help and advice of a professional accountant or real estate lawyer to advise you.

We can direct you to resources you can use to educate yourself as an Indian national NRA (nonresident alien) buying land in the US. The IRS Publication 515 does a decent job summarizing the rules for NRAs.

The Foreign Investment in Real Property Tax Act (FIRPTA) of 1980 was enacted by Congress to impose a tax on foreign persons when they sell or receive income from a US real property interest.

There is so much to wrap your head around regarding taxes, again we suggest you seek out the advice and make a plan with a professional lawyer or international tax adviser.

Here are a few topics you can discuss with them:

Tax Rates

Indian investors of US real estate need to pay taxes on any income earned in the US. This means that you will have to pay taxes on the income from your property (if any). So if you are making any income from your land purchase, you’re going to have to pay taxes on that income. I think that tax rate is 30%, it might be lower if there’s a treaty between the US and India.

Foreign Investor Tax Withholding (applies to Indians)

When you or your kids, your grandkids, go to sell the property down the road they will need to pay a 15% withholding tax because you’re a nonresident. I believe there are some exemptions to this but I’m not sure what they are.

Capital Gains Implications

When you sell your land in the US, any gain is taxed as if the property had been sold by a US citizen or resident. This means the gain might qualify for lower long term capital gains treatment, if the property has been held for more than 12 months.

This is a great topic for you to discuss with your accountant and advisor. If you don’t have any experience with US real estate, it might be worth it to hire an expert who has dealt with Indian investors to help you.

State Tax

Depending on the state, there may be state tax withholding or tax liability.

1040NR

As an Indian NRA, you would be required to file a 1040NR tax return to report the income from real estate and any associated withholding if the 871(d) election is made. You will first need to obtain a US Taxpayer Identification Number (TIN) from the IRS to file a tax return.

If you’re trying to find an example of an Indian man who has successfully purchased property in the US, you can check out this guy’s YouTube channel. He has a couple of videos about his land purchase in Washington state.

Note: I don’t know this man, Compass Land USA doesn’t have any affiliation with him. I just came across his videos and thought they might be helpful to our Indian audience and customers.

Are you an Indian citizen looking to buy land in the US?

Compass Land USA can help you with your land investment! Call or Text us anytime at (313) 349-0434 😊

Want Your Own Indian Land Buying Guide?

Hi i would like to know how can i invest in US real estate buying a residential property .

I am a Indian staying in Dubai and the sole purpose is to make an investment.

So what are the things i need to keep in mind in order to proceed ahead.

Property value , Financing options, rental returns and what kind of capital appreciations.

And specifically what is owner financing ?

Hi Sanjay! The good news for you is anyone can buy land in the US. Good things to consider: property value, location, financing, property details (HOA/POA, flood zone, wetlands, etc. etc.), property taxes. We have a post that goes over all this in detail – https://www.compasslandusa.com/questions-ask-buying-land/.

This post will go into the details of owner financing – https://www.compasslandusa.com/how-to-buy-owner-financed-land/

Good luck! If you have any questions about one of our parcels, you can call or text us anytime at (313) 349-0434.