From the video:

Are you wondering how foreigners can buy land in the US? It’s not as complicated as you may think! In this video, Felicia discusses a foreigner’s guide to investing in US land.

This post is not going to cover how to buy houses, residential buildings, commercial buildings or otherwise. We are strictly talking about land here!

Can Foreigners Buy Property in the USA?

Yes, foreign citizens can buy land in the U.S.!

The good news is, if you’re paying cash for a property, that’s all you need. That’s right – no citizenship is required to purchase land for cash in the US. There are no citizenship requirement for real estate sales in the USA, any non-US citizens can buy any property. Anyone may purchase and own property in the United States, regardless of citizenship. There are no laws restricting a person from buying a property in the USA.

Does Buying Land in the US Grant Me Citizenship?

No, sorry. We get this question a lot from our foreign clients. Unfortunately, buying land in the US does not grant you citizenship, nor does it give you a legal right to live here. Investing in US real estate doesn’t automatically put you on a path to citizenship.

Immigration in the US is more strictly regulated than foreign investment. Since the signing of the Patriot Act in 2001, the rules to enter the US have become much more disciplined.

We are not immigration experts – if you are trying to figure out how your immigration plans aligns with your real estate investment plan, you should seek out the advice of an immigration lawyer to help you.

Major US Destinations for Foreign Buyers

Where can foreigners buy property in the United States? Location is totally subjective. It very much depends on what you want to use the property for. Is your goal long-term sit and hold? You need to make sure you do your research and check paths of growth of nearby cities. You should also look into whether the state is growing economically and in population.

Even though location is subjective, there are some locations that are popular with foreign buyers.

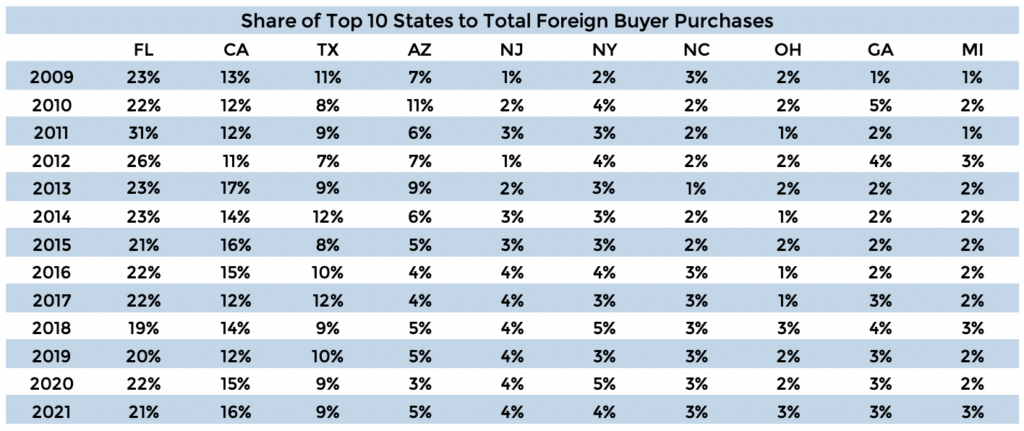

Per the NRA, Florida and California are the most popular state for foreign. This makes sense right, the coasts. So depending what side of the world you’re on, the coast closer to you has a lot of appeal. Also on the list are Texas, Arizona, New Jersey, New York, North Carolina, Ohio, Georgia, and Michigan.

Michigan and Ohio are surprising here. California, Texas and Florida make sense because they’re popular states, they have good population and economic growth. Right now in the US there’s an exodus of people from California and they’re landing in places like Texas, Florida, Arizona, and Nevada. I wouldn’t be surprised if that trend pops up in international investment as well. We might see more interest from foreign buyers purchasing more land in Florida as a result.

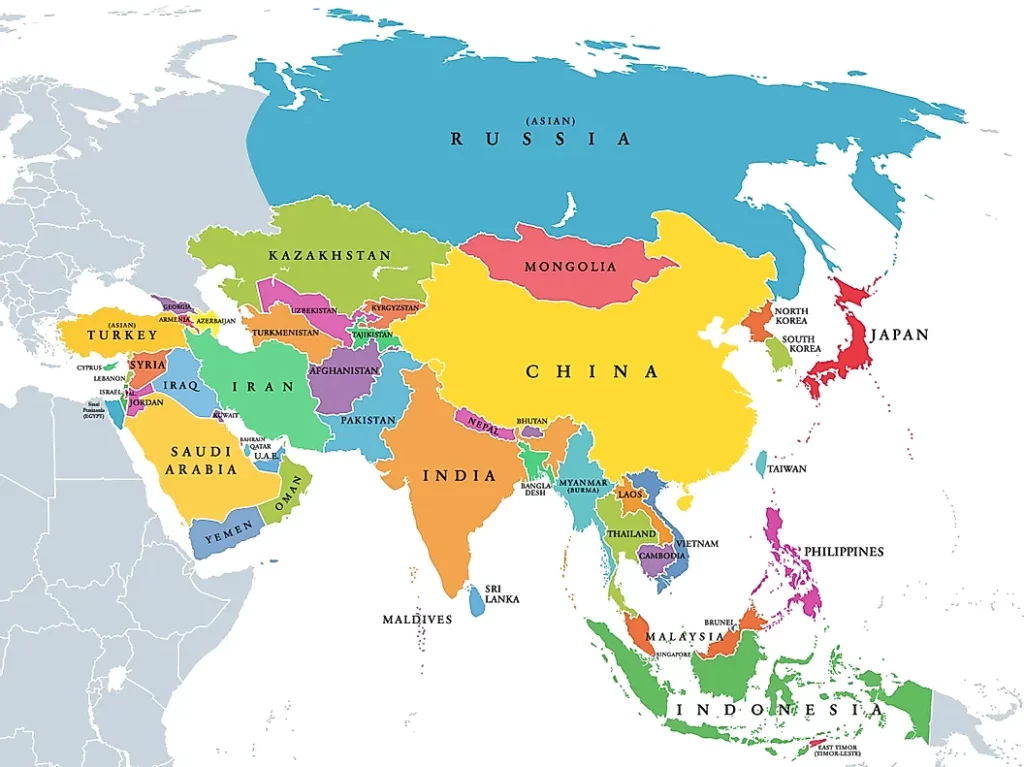

Where are Foreign Buyers of US Land From?

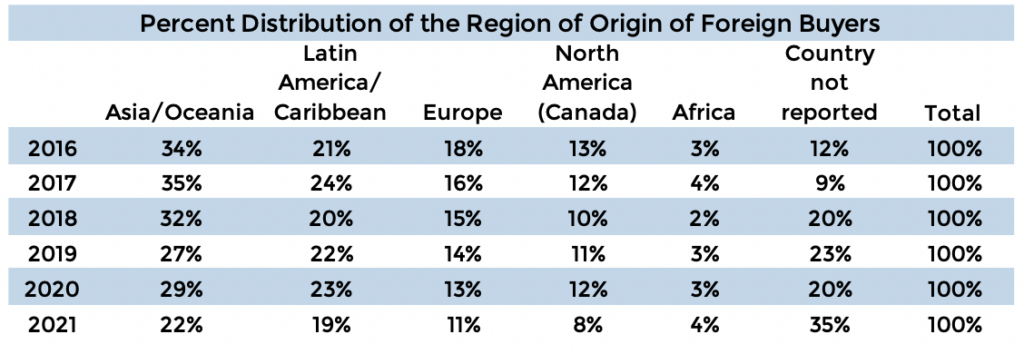

Most foreign buyers of US land are from the region of Asia, per the NRA. Making up 22% of total foreign buyers.

The Asia/Oceania region covers an area with enormous wealth, from Saudi Arabia to Japan.

So it makes sense for people in this region, who may be in a more volatile country, to invest in US real estate, which has historically been more stable than other countries. It’s also a more affordable investment.

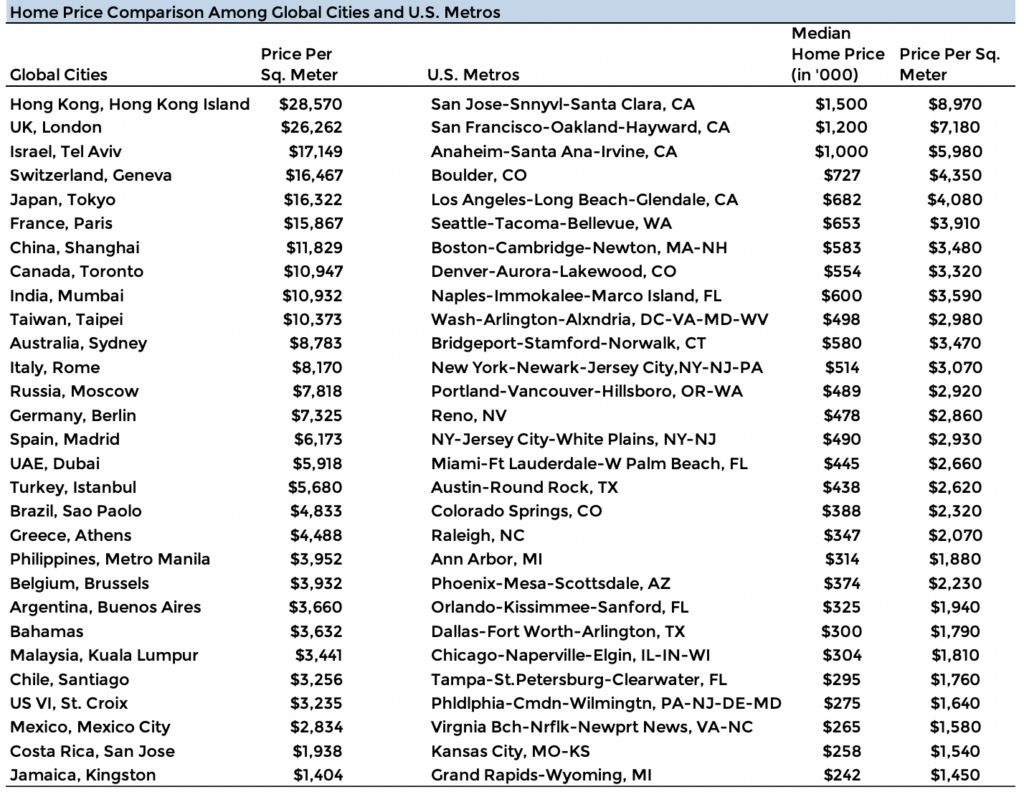

In the image below, you’ll see the price per square meter of a home in Hong Kong is $28,570! That means for your average 1,500 square foot home your purchase price is over $42 millions dollars! YIKES.

Now you compare that to the U.S., even in a more expensive area like San Jose, California, the price per square meter is $1,500. Much more realistic and affordable. So for foreigners looking to invest in real estate, but can’t afford to do so in their own countries or metro areas, the US is an enticing option.

How To Buy Property In the USA as a Foreigner?

If you’re going to purchase a piece of land with cash, that’s all you need! Make sure that the person selling you the property is legit, and can answer all your due diligence questions.

If you’re buying a property through our company, Compass Land USA, we’ll walk you through our safe and easy process for buying one of our properties for cash.

Can foreigners qualify for a mortgage in the US?

Yes, foreigners can apply for a mortgage in the USA even without a US credit history. However, you should know that getting a mortgage for a land purchase can be extremely difficult. It’s a challenge even for US citizens and residents.

If you’re looking to get a conventional loan from an American bank, you’re going to face a much more difficult process. If you’re living abroad, you can expect to come up with 50% down payment for the property. If you’re living in the US, you’re going to face a lot of questions and the bank’s decisions could be based on whether or not you are a citizen or green card holder. This is not going to be an easy route.

What’s the easiest way for foreigners to buy land in the US?

The easiest way for you to buy land in the US is with cash. Pay for the property in full, the title transfers to you immediately, done deal.

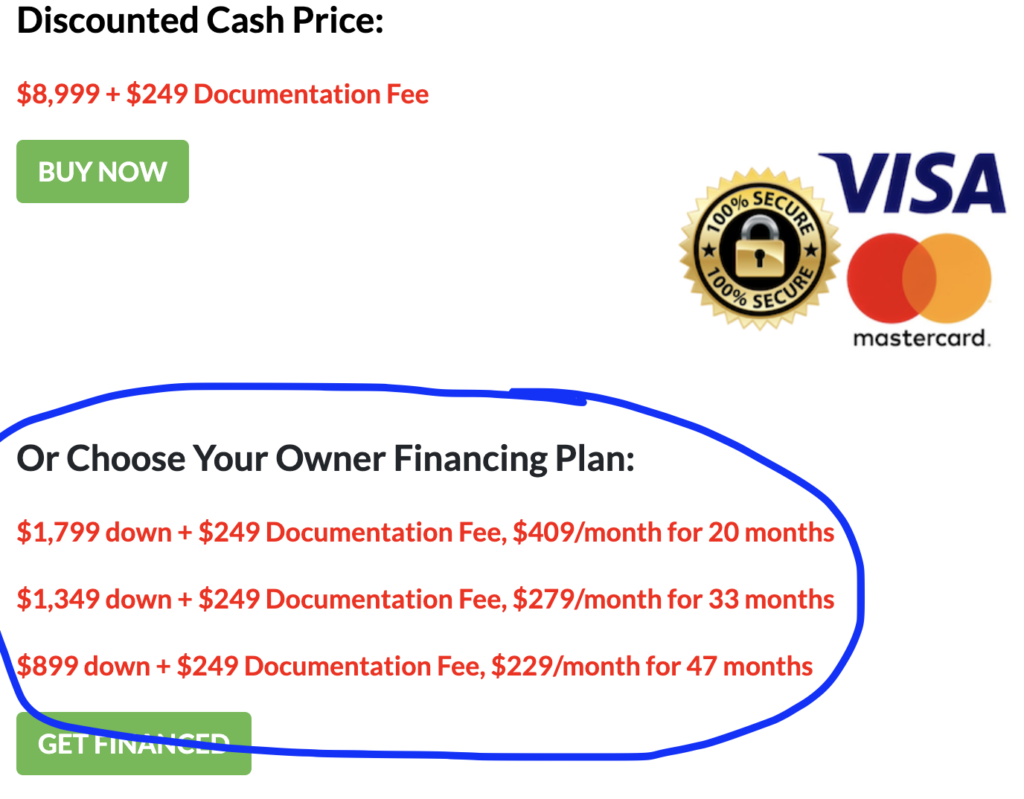

If you really can’t come up with the cash and you don’t live in the US, the next best thing for you to do is to owner finance. You can try to do this through the company you are buying property from.

At Compass Land USA we offer owner finance on almost all our properties. There are normally 3 plans to choose from.

We don’t require credit checks, there are no prepayment penalties. You can learn more about our owner financing process here.

Note: We do not offer financing for other seller’s properties. We only offer owner financing for properties that we are selling.

Steps Involved in the US Land Buying Process for a Foreigners

- Find your perfect property (you can do this easily online – no plane ticket required)

- Complete your due diligence steps (we have a free DD checklist you can refer to for help)

- Agree on a purchase price

- Arrange for the money needed to complete the transaction OR speak with the seller about owner financing

- Sign a Purchase Agreement

- Send payment and receive the deed to your new property!

At Compass Land USA we have an easy and safe process for buying land with cash and with owner financing.

How Long does the Property Purchase Process take in the US?

If you are closing through a title company (which we would recommend if you are a foreign NRA (nonresident alien) you can expect 30-60 days to close your land purchase.

If you are closing directly with the seller, it shouldn’t take more than 10 business days.

How long can you stay in the U.S. if you own property?

Solely based on buying a house in the USA, you are not granted any additional perks like acquiring residency. Once you have entered the USA on a Visitor/Business (B1/B2 Visa), you can stay up to six months. Other visa statuses have different stay durations.

Tax Implications for Foreigners Buying Property in the USA

We are not tax experts and cannot give you tax advice. You should seek out the help and advice of a professional accountant or real estate lawyer to advise you.

We can direct you to resources you can use to educate yourself as a foreign NRA (nonresident alien) buying land in the US. The IRS Publication 515 does a decent job summarizing the rules for NRAs.

The Foreign Investment in Real Property Tax Act (FIRPTA) of 1980 was enacted by Congress to impose a tax on foreign persons when they sell or receive income from a US real property interest.

There is so much to wrap your head around regarding taxes, again we suggest you seek out the advice and make a plan with a professional lawyer or international tax adviser.

Here are a few topics you can discuss with them:

Tax Rates

Foreign investors of US real estate need to pay taxes on any income earned in the US. This means that you will have to pay taxes on the income from your property (if any). So if you are making any income from your land purchase, you’re going to have to pay taxes on that income.

Foreign Investor Tax Withholding

When you or your kids, your grandkids, go to sell the property down the road they will need to pay a 15% withholding tax because you’re a nonresident. I believe there are some exemptions to this but I’m not sure what they are.

Capital Gains Implications

When you sell your land in the US, any gain is taxed as if the property had been sold by a US citizen or resident. This means the gain might qualify for lower long term capital gains treatment, if the property has been held for more than 12 months.

This is a great topic for you to discuss with your accountant and advisor. If you don’t have any experience with US real estate, it might be worth it to hire an expert who has dealt with foreign investors to help you.

State Tax

Depending on the state, there may be state tax withholding or tax liability.

1040NR

As a foreign NRA, you would be required to file a 1040NR tax return to report the income from real estate and any associated withholding if the 871(d) election is made. You will first need to obtain a US Taxpayer Identification Number (TIN) from the IRS to file a tax return.

Are you a foreigner looking to buy land in the US?

Compass Land USA can help you with your land investment! Call or Text us anytime at (313) 349-0434 😊

Want Your Own Foreigners Land Buying Guide?

Download Your FREE “Foreigner’s Guide to Buying Land in The USA” Below

Just put in your name and email, click “Download” and you will have access to the free step-by-step guide right away.

I am NRA, currently living un México. I wish to know, given that a foreigner can Buy land, if The property title can be put onto a us citizen minor, i.e. my son or daughter.

Hi Enrique. First off, yes you can buy land as a foreigner, and you can put the property title into whosever name you wish 🙂 We’ve had people buy land from us as a gift for their children and grandchildren.

Great read! This blog post provides a comprehensive guide for foreigners interested in buying land in the USA. The step-by-step breakdown and legal insights are incredibly helpful. It’s reassuring to have a resource like this to navigate the complexities of land acquisition. Thanks for sharing!

Glad you found it helpful, Lauren!

Hi, I have one single member LLC in the US , can I use my LLC to buy the land ? Thanks.

Hey Joyce. As a quick answer – you could. Take a minute to consider your long term goals of the property, because it may affect how you choose to purchase it. It’s always a good idea to triangulate with a real estate lawyer and accountant for professional advice 🙂