What is a Property Deed? What Does a Property Deed Look Like? Which Property Deed Should You Use? What Types of Deeds are Used in a Land Purchase?

When you get to the stage of purchasing a property, a property deed is used to transfer the title from the current owner and seller, to the next owner – you! So, what does a property deed look like? How do you know which of the 5 types of deeds to use?

How is a Property Deed Different from Property Title?

As you begin looking into a property to buy, and then finding one you want to purchase, you start to hear a lot of real estate jargon thrown around.

Chain of title. Liens, back taxes, encumbrances. Notarizing deeds.

For someone making a first-time land purchase, this can make your head spin. Chain of title? Deeds – plural? As in there’s more than one? How do I know which one to use?

Property Chain of Title

The first important point here is that title and deed are not the same things. The title is the legal part of property ownership. To say you own the title to a property is to say that you own the legal rights to it. When land investors like myself talk about the chain of title, I’m talking about the previous owners.

Before you purchase any property, especially rural vacant land, you should be establishing the chain of title. This means you can track the property’s previous owners (in a chain one behind the other) back in time at least 30-40 years. There are no gaps where you don’t know who the owner was.

You can do this by hiring a title company to do a title search for you, or you can try doing it yourself using the property’s parcel number (APN). If you’re new to buying land, I would recommend hiring a title company, because this process can get extremely detailed and confusing to understand.

While you’re in the weeds establishing a chain of title, or have hired a title company to do that for you, you should take a look at the Mineral Rights. You can learn more about why that’s important here.

So, the title refers to your legal right to owning something, in this case, land. You’ve proven that by establishing a chain of title.

What then, is a deed?

What is a Property Deed?

A property deed is a legal document that actually transfers the property ownership. Deed and title go hand-in-hand. A deed must be a physical piece of paper, according to the Statute of Frauds.

The Statute of Frauds refers to a requirement that certain contracts must be in writing, signed by all parties included in the transaction. The contract must include the subject matter, costs/price associated with it, the grantee/buyer and grantor/seller, and any other parties involved (e.g. a notary). This protects the parties and assets involved, making sure there is enough evidence to support the contract in a legal setting, if necessary.

A deed is used in real estate transactions to legally convey the property title and ownership to the grantee/buyer from the grantor/seller. Once a deed has been signed by all the required parties, it must be recorded in the County’s Clerk of Records office for it to be completely withstanding. Neglecting to file the recorded deed doesn’t mean you lose ownership of the property. It just becomes difficult to prove your ownership and can have all kinds of implications – like potentially losing your property to a county tax lien sale.

If you have the deed signed and notarized, record it. In some counties, you can record a deed online with third-party services. Other counties require you to file deeds in person, at the records office. A quick call to the county will tell you which camp you’re in.

Which Property Deed to Use for Land Purchase?

So, now you know that a title is a legal right to your property, and a deed is a vehicle that gets you full title. Great! You just need to record the deed with the county and you’re good to go!

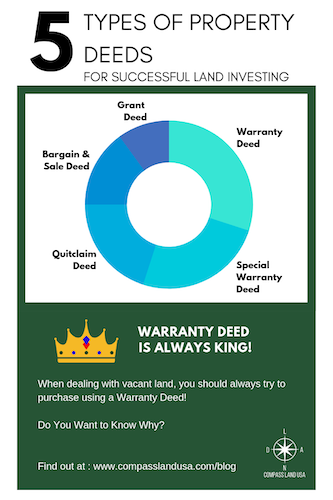

But how do you know which deed to use? There are 5 main different types of property deeds, and each one is used in very specific situations.

What is a Warranty Deed?

As far as property deeds go, this first one is the best of the best. It is commonly used in real property sales. This type of deed means that the grantor/seller is guaranteeing the grantee/buyer of a very important key feature:

That there were no issues with the title of the property, and that there are no debts or liens out on the property. Not just for the ownership period of that buyer, but for the entire history of the property!

This is nothing short of incredible. The grantor is guaranteeing the grantee that for the property’s entire history, there have been no issues around the title of the property! The grantor is using this deed to let the grantee know that they have the full legal right to sell that property and that the property is free of debt and liens.

If this is proved to be incorrect at any point in time in the future, after the transaction, the grantor will be held responsible and must prove the title chain of the parcel or compensate the grantee for any unsettled back taxes or liens. You are guaranteed for life, or as long as you choose to own the property.

A Warranty Deed offers the highest level of protection for a land buyer. By the way, we use this deed for our buyers at Compass Land USA, to make sure you feel completely safe and are happily satisfied with your land purchase.

If you’re looking to buy a property and the grantee isn’t willing to use a Warranty Deed, you should ask them about it. Why not? Are there issues about the property you don’t know about? Are there debts and liens currently owed on the property?

If you can’t get a Warranty Deed, it doesn’t mean your land buying dream is dead. There are a handful of unique situations where a Warranty Deed doesn’t apply. It does mean that you’re going to have to dig deeper into the property history and that you should fully understand that history and be comfortable with it before advancing with the land purchase.

What is a Special Warranty Deed?

This second type of deed is similar, but not exactly the same as a Warranty Deed, and doesn’t provide as much protection to the buyer as a Warranty Deed does. A Special Warranty Deed is different because the grantor doesn’t cover the property’s entire history (where a Warranty Deed, would remember).

The grantor only guarantees against claims or issues with the title that occurred during their ownership. The guarantee doesn’t extend beyond the years of their ownership, either in the past or into the future. The grantor cannot be held legally responsible for any issues with debts or titles that occurred outside of their ownership.

The grantor, similar to a Warranty Deed, is guaranteeing that they have the full legal rights to sell that property.

A Special Warranty Deed is often used in commercial property sales. A variation of the deed is the General Warranty Deed, which is commonly used in property transactions.

It’s okay to use a Special Warranty Deed. Using this deed doesn’t mean that you shouldn’t move forward with your land purchase. Please don’t think that the other deeds in this post are useless, just because the Warranty Deed is the best of them!

I’ve purchased properties on a Special Warranty Deed. Remember when I said that a good title chain can establish property ownership history 30-40 years back? I’ve used a Special Warranty Deed to purchase a property from grantees who have owned their property for 40 or 50 years. This exceeds the recommended title chain length!

I felt comfortable using a Special Warranty Deed in this specific situation. The grantee couldn’t remember the full history of their property, so they weren’t comfortable using a Warranty Deed. With a bit of extra work, I was able to get a copy of their deed and perform my title chain search even farther back from their ownership.

What is a Quitclaim Deed?

This third deed type is usually used between family members or friends and acquaintances. You may sometimes hear it referred to as a Non-Warranty Deed.

This deed is most commonly used between people who know each other. It may also be used when there’s nothing being sold or there’s no money being exchanged.

A Quitclaim Deeds offers almost no protection to the grantor. There’s no guarantee of title chain, full property ownership, or that the property is free of liens and debts. There are no guarantees regarding the quality of the title.

You can also use a Quitclaim Deed to correct any issues on the original deed, such as the misspelling of someone’s name, missing signatures, failure to record the document with the county or to bring a document into compliance with county standards.

I would not recommend using a Quitclaim Deed to purchase property unless it’s from someone you really know and trust because there’s a lot at stake. You want to keep this transaction as low-risk as possible.

What is a Bargain and Sale Deed?

The fourth type of deed is a Bargain and Sale Deed. This deed should only be used in very specific instances.

Like the other types of deeds mentioned here, it technically transfers the ownership of a property from the grantor to the grantee. What the Bargain and Sale Deed is really saying is it’s transferring the right to sell the property in the future. It doesn’t cover any guarantees around the title – which the actual legal right to owning the property!

In simple terms, the Bargain and Sale Deed transfers the right to the grantee to sell that property in the future but does not necessarily transfer the title of the property.

Sneaky! So, you’re not guaranteed actual title and ownership to the property, nor are you guaranteed that the property is free and clear of any debts or liens and other encumbrances. The grantor is not taking any credit or responsibility for what happened to the property before or after their ownership. The grantor is essentially washing their hands of the property.

Use of this deed implies that the seller might have the proper title to the lot, and might be allowed to convey it – but it’s not guaranteed and there are no consequences. I would avoid buying a property with this deed!

What is a Grant Deed?

The fifth and final type of deed we’re going to go over is the Grant Deed. A Grant Deed transfers ownership of a property from the grantor to the grantee in exchange for a pre-determined price. Unlike a Quitclaim Deed, the grantor and grantee usually don’t know and aren’t familiar with each other.

This deed guarantees that the grantor hasn’t already granted the title to someone else. With this deed, no one else can buy the property out from under you. It doesn’t guarantee that the title chain is clear (where a Special Warrant or Warranty Deed would), or that the property is free of liens and debts.

A Grant Deed can be used to transfer property rights to a Trust or a business. They’re great to use in that situation, but if you’re buying land from a private owner or company as an individual, I wouldn’t recommend using this type of deed.

What Does a Property Deed Look Like?

Each of the 5 types of deeds we’ve gone through will be structured slightly differently. They will all have some common components:

- The full name of the grantor/seller (and any additional sellers)

- The full name of the grantee/buyer (and any additional buyers)

- The physical location of the property

- The legal description of the property

- A statement describing that the grantor/seller is the rightful owner of the property, and has a legal right to transfer the title

- A statement describing that the grantor/seller will take whatever steps necessary to ensure the property ownership and title is successfully transferred to the grantee/buyer

If you’re using a Warranty Deed or Special Warranty Deed, it may contain a statement describing that the property is free and clear of all liens and debts and that there are no outstanding claims on the property.

If you can get a copy of the previous deed used to transfer the property, you can use that as a guideline to create yours. If you’ve never bought or sold a property before, I really suggest contacting a paralegal or lawyer to help you create the deed document and make sure it’s legally binding.

Bottom Line

When you’re looking at purchasing a piece of land, there are 5 main types of deeds that you can use: Warranty Deed, Special Warranty Deed, Quitclaim Deed, Bargain and Sale Deed, and a Grant Deed.

A Warranty Deed is the best of the best. It protects you from all future and past issues with property title and any outstanding debts or liens.

If you’ve never bought or sold land before and don’t know how to craft your own deed, I would recommend using a paralegal or lawyer to help you out. You can even use a website like RocketLawyer for easy online assistance.

At Compass Land, we don’t mess around with Quitclaim, Bargain and Sale, or Grant Deeds. We are confident in our properties and the healthy state in which we bought them. That’s why we only use Warranty or Special Warranty Deeds. The deed type we use is dependent on the specific property.

If you have any questions about the deeds that we use or how we convey you a property, please leave a comment below. I look forward to hearing from you!

The information in this article should not be interpreted as legal advice. I’m not a lawyer, and if you’re considering doing a title search I would recommend getting help from a title company or a paralegal to find out what your options are. It can be difficult and overwhelming to do a proper title search, especially to someone without experience. To be certain of what rights are included with your property, a local title agency or paralegal can help you.

Are You Looking for More Info?

How You Can Become a Land Buying Expert – Download our FREE Guide here. Or, you can feel free to contact us anytime if you have questions, want to easily and safely buy land, or want to just learn more about how we can help people like you search for land as an investment.

Get the FREE Guide and then give us a call at (313) 349-0434 and we’ll discuss how you can easily buy land with little money using our automatic approval owner financing.

Common search phrases for Types of Property Deeds:

- Types of deeds pdf

- Types of deeds used in land purchase

- Property deed transfer

- Types of deeds in NJ

- Types of deeds in PA

- Types of deeds in Florida

- General warranty deeds

- Types of deeds in California

Nice brochure; there are typos (poor hyphenation) in it. Thought you should know.

You might want to be a bit stronger on encouraging title reports and title insurance. It is the only true way to protect both parties.

Good luck with your business of buying and selling vacant land.

Thanks for the feedback, Anne! We will definitely revisit the infographic and check for typos. We do buy/sell quite a bit of property with title insurance, but only above a certain price point. Cheers!

I am not a Realtor, but have subdivided and sold somewhere between 8,500 and 10,000 parcels of land. All Title Companies are not the same, by any means. They are only as good as their Property Search Department. The Best I’ve worked with is the original Stewart Title & Trust, when they first broke away from Transamerica. The worst, by far, has been First American Title and Trust, whose ineptitude has cost me close to $1M, maybe more. Surprisingly, an online Company, Entitle, has really impressed me. No errors, no complaints, and lightning fast. AND lowest cost to date. Most offer Escrow services, with First American again at the bottom with poorly educated Escrow officers and absurdly high fees. Entitle wins that toss.

Hi G J! Thank you for sharing your experience. I can’t believe it cost you $1M! Yikes! I hope everything worked out the way you needed it to in the end!

Deed recording is also for taxing purposes and as new owner of property you will not receive tax bill until deed is recorded. Fact!

Hi Alvin! Thank you for that input, it’s much appreciated! 🙂

Hate to become the enemy, but beware Title Insurance Liability Exclusions. ALTA-type insurance(CLTA, NYLTA, OLTA, etc ) inure the insurer of Liability. I teach Construction Law and Contracts for two Colleges. A careful reading will show you they are only required to correct their errors and omissions if, and when, they are convinced of same. That is the ONLY adjustment to fully satisfy their liability exposure. If you need REAL insurance, you must buy a Litigation Assured Title Policy. Only $1k more, but the Title Company will go to Court for you. AND they have a boatload of cash to support their claim. WORTH EVERY PENNY.

Hello again G J! Thanks for shedding some light on this for us. Not many people have experience with Construction Law. Appreciate your input!

Hi! Thanks for that information, this conversation helped me. I wouldn’t mind learning more in Contract Law and Notices. The world runs on contracts and now smart contracts. when I started reading on contract law, I was blown away! So much information people over look or not read. Do you have a web site or podcast?

Hey Chris! We don’t really refer to any legal sites or podcasts, at this point it’s mostly in the memory bank. I do agree that smart contracts are going to be the thing of the future – just not clear on how they’re going to work yet, or if they’ll be on blockchain or not. Things to keep an eye on!

Looking to add four family members to existing deed. What are my options?

Hi Darrell! You could try using a Quit Claim deed to add your family members to the property. You can also give the County’s Assessor Office a call, or enlist the help of a title company to see what they think, and have them do the work and recording for you. Good luck!

In actuality, the Grant deed is the most superior type of deed. I don’t know why this site is undermining the power of it but make no mistakes. The Grant Deed is #1.

Hi Resa. Thanks for reaching out! What is it about the Grant deed that makes you think it should be #1 on the list?

I want to sell my residential property .what deed should I use.

Hi Gina! To be honest with you, we don’t have any experience with residential properties / homes. Unfortunately, I’m not comfortable advising you and potentially sending you down the wrong path. You could try talking to a real estate lawyer in your area, they should definitely be able to help you out! 🙂

my mom passed away a few months back leaving me her estate so who do I go to exactly to find out where the property lines are because I have asked the lending company the deed owner the title owner the land assessment the county city state town surveyor and the townsmanship council and no one seems to know where the property line actually does in fact end or begin they say that there is record of 1/4 of an acre is with/part of the structure being part of the property but they don’t know if the back equaling the initial 3 acres my mom said she owns everyone sees it’s on their maps but have no clue who is actually claimed owner by title or deed or if it is still a part of my mom’s land and they don’t know why it’s not recorded so who do you ask when all those other people say they don’t know . the deed has numbers of encumbrances lateral n longitude degrees ext . all of which make no sense to me whatsoever .. I did however find a document stating that the townsmanship was claiming parts of residential properties and that if an individual felt it to be unfair or contestable that they could go to the next town meeting and voice their issues at which time would be settled with the township so who do I go to to find out exactly where the land has been claimed for not claimed

Hi Dutchess. I’m sorry to hear you’ve been having such a tough time with all this. To find out where the corners are, you can have a property surveyed. It’s a good idea to get a local surveyor who is familiar with the county and the county mapping system. If the title is in question, you can also hire a title company to verify the chain of ownership for you.

If the title company is able to prove you own the property and the town is in fact trying to claim parts of it, you should definitely go contest it at the next meeting! Hopefully this helps point you in the right direction. Good luck!

Great information and really helpful but I was looking for an answer to a specific question: If I’m selling some parcels of land, can I deed my property into the name of someone else’s trust or do I have to quit claim it to them first, then they can deed it into their trust themselves?

Hey Jack! Whether you can deed your property into the name of someone else’s trust or whether you need to quitclaim it to them first would depend on the specific details of the trust and the laws of your jurisdiction. You should recruit a lawyer who can help you sort it out based on your area and the location of the property. Hope this helps!

Great article, Felicia and thank you for it. Does your company buy/sell land in all 5 states? How many years have you been in business, and how many properties do you think you have purchased?

Thanks! Brian

Hey Brian! If you meant all 50 states, then no. We have our favorites 🙂 We’ve been in business for over 6 years, and have purchased over 300+ properties. If you know anyone who is looking for land, pass on my info and we’ll see how we can help them out. Cheers!

The explanation given to each type of deed is comprehensive and convincing.Accidently ,I did get a chance to go through your article.Hearty thanks and congrats.wish new endeavours in this series…..thank you

You’re very welcome! I’m glad it helped 🙂