From the video:

Are you looking to invest in land, but keep getting tripped up over flood zones? It can be messy to try to sort through it all. In this video, Felicia lays out the different types of flood zones, and what they each mean.

Why do Flood Zones Matter When Investing in Land?

Flood zones are areas that have a higher risk of flooding due to their location and topography. These zones are designated by the Federal Emergency Management Agency (FEMA) and are based on flood risk data from various sources, including topographic maps, flood insurance rate maps, and floodplain management regulations.

A flood zone is an area that is at risk of flooding from nearby bodies of water, such as rivers, streams, and coastlines. These areas are designated by the Federal Emergency Management Agency (FEMA) and are divided into different risk categories based on the likelihood of flooding.

A flood plain is a flat or low-lying area adjacent to a river, stream, or other body of water that is at risk of being flooded. Flood plains are typically formed by sediment deposited by the water body over time, and they are often characterized by their flat, low-lying terrain.

Flood zones and flood plains are related, but they are not the same thing. Flood zones are designated by FEMA and are based on the risk of flooding, whereas flood plains are physical features of the landscape. A property may be located in a flood zone but not in a flood plain, or it may be located in a flood plain but not in a designated flood zone.

Flood zones are important to consider when investing in land because they can affect the value of the property and the insurance premiums required to protect it. Properties located in flood zones may be at higher risk for flood damage, which can be costly to repair and disrupt the use of the property. As a result, insurance premiums for properties in flood zones may be higher, which can impact the overall cost of ownership.

Additionally, properties located in flood zones may be subject to certain regulatory restrictions, such as building codes and zoning requirements, which can affect the development potential of the land.

What Are the Different Types of Flood Zones?

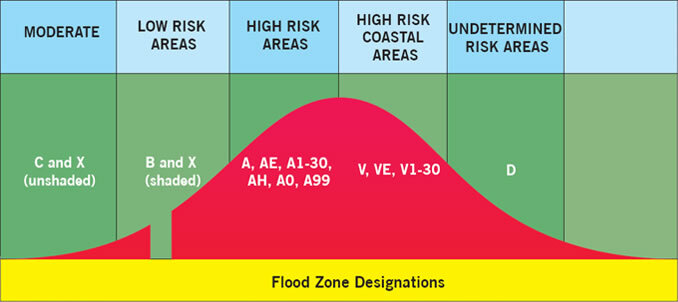

There are several different types of flood zones, each with its own level of risk and associated insurance requirements.

High-risk flood zone (also known as a “Special Flood Hazard Area” or SFHA) has a 1% or greater chance of flooding in any given year, and is also known as a 100-year flood zone. Properties located in high-risk flood zones are required to carry flood insurance.

Within the high-risk flood zone category, there are several subtypes of flood zones that are used to identify specific areas of flood risk:

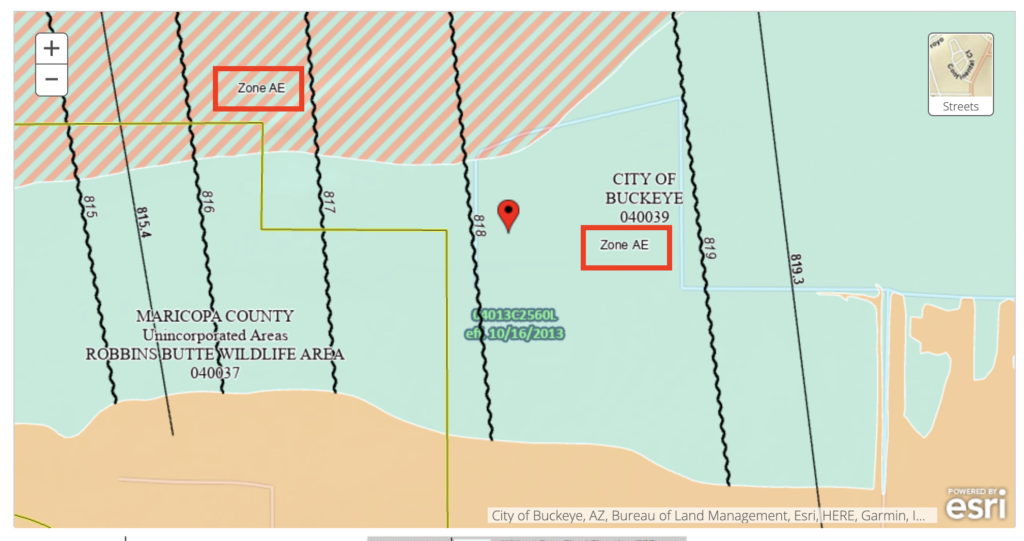

What is Flood Zone AE?

This type of flood zone is designated as an area with a high risk of flooding from a 100-year flood. Properties located in zone AE are required to carry flood insurance.

What is Flood Zone A?

This type of flood zone is designated as an area with a high risk of flooding from a 100-year flood, but without detailed data on the flood risk. Properties located in zone A are required to carry flood insurance.

What is Flood Zone AH?

This type of flood zone is designated as an area with a high risk of flooding from a 100-year flood, but with lower water levels than in zone AE. Properties located in zone AH are required to carry flood insurance.

What is Flood Zone AO?

This type of flood zone is designated as an area with a high risk of flooding from a 100-year flood, but with a shallow depth and a relatively slow rate of flooding. Properties located in zone AO are required to carry flood insurance.

What is Flood Zone V?

This type of flood zone is designated as an area with a high risk of flooding from a 100-year coastal flood. Properties located in zone V are required to carry flood insurance.

Moderate- to low-risk flood zones (also known as an “Area of Minimal Flood Risk” or AMFR) have a lower risk of flooding than high-risk flood zones. Properties located in moderate- to low-risk flood zones may not be required to carry flood insurance, but it is still recommended.

Within the moderate- to low-risk flood zone category, there are several subtypes of flood zones that are used to identify specific areas of flood risk:

What is Flood Zone B?

This type of flood zone is designated as an area with a moderate to low risk of flooding from a 100-year flood. Properties located in zone B may not be required to carry flood insurance, but it is still recommended.

What is Flood Zone C?

This type of flood zone is designated as an area with a minimal risk of flooding from a 100-year flood. Properties located in zone C may not be required to carry flood insurance.

What is Flood Zone X?

Zone X: This type of flood zone is designated as an area with a minimal risk of flooding from a 100-year flood. It’s not considered to be a high-risk area. Properties located in zone X may not be required to carry flood insurance.

What is Flood Zone D?

This type of flood zone is designated as an area that has not been studied in detail, but is believed to have a moderate to low risk of flooding. Properties located in flood zone D may not be required to carry flood insurance, but it is still recommended.

Undetermined risk flood zones in the U.S. may still be at risk of sustaining a flood at least once every 100 years, but no analysis has been conducted in the area. Flood insurance is still available in this zone and its purchase is strongly advised.

It’s important to note that flood risk can vary significantly even within a single flood zone, and it’s always a good idea to consult with a professional or your insurance company to determine the specific flood risk for your property.

Which Flood Zone is The Worst?

It is difficult to determine which flood zone is the “worst” as the severity of a flood can depend on various factors such as the intensity and duration of the rainfall, the topography of the area, and the infrastructure in place to mitigate flood damage.

Additionally, different areas may be more or less vulnerable to flooding based on their geographic location, local weather patterns, and other factors.

In general, high-risk flood zones have a higher probability of flooding and are more likely to experience more severe flooding events. These areas may require property owners to purchase flood insurance and may have stricter building codes and floodplain management regulations in place to reduce the risk of damage.

However, even areas that are considered to be at lower risk of flooding can still experience flood events, and it is important for all property owners to be aware of their flood risk and take appropriate precautions.

How Do I Find Out What Flood Zone I’m In?

You can find out what flood zone you’re in by using the following steps:

- Go to the FEMA Map Service Center website

- Enter your address into the search bar and click “Search.”

- View your results on the map

You can use the legend at the bottom of the map to determine which color corresponds to which flood zone.

Keep in mind that flood zone maps are periodically updated, so it’s a good idea to check the website regularly to ensure that you have the most up-to-date information.

How Do I Get Flood Zone Insurance?

If you’ve determined that you live in a high-risk flood zone or an area with a high risk of flooding, you may be required to carry flood insurance. Flood insurance is a separate policy that can cover buildings (homes) and the contents within the building.

Per FEMA, the average annual flood insurance policy premium is $700. That’s a fairly low annual cost to protect you from flood damages – and just 1 inch of floodwater can cause up to $25,000 in damage!

You can purchase flood insurance through:

- your insurance agent or broker (If you need help finding a provider go to FloodSmart.gov/flood-insurance-provider)

- National Flood Insurance Program: a federal program that offers flood insurance to homeowners, renters, and business owners in participating communities

- private insurance companies

- state-run insurance programs

Once you’ve chosen a provider, you need to decide between a standard policy and a preferred risk policy. A standard policy covers buildings and contents, while a preferred risk policy covers either buildings or contents.

After you’ve chosen a policy and coverage amount, you’ll need to pay the premium to start your flood insurance coverage. Keep in mind that flood insurance premiums are typically paid on an annual basis.

It’s a good idea to shop around and compare quotes from different insurance companies to find the best flood insurance policy for your needs. You can also consult with your insurance agent or broker to help you choose the right policy.

Do Flood Zones Affect Your Land Purchase?

Flood zones can potentially affect the value of a land purchase and the feasibility of building on the land. If a piece of land is located in a high-risk flood zone, it may be more difficult to get bank financing to purchase the property and more expensive to insure. As you now know, property owners in high-risk flood zones may be required to purchase flood insurance as a condition of their mortgage.

In addition to financial considerations, flood zones can also impact the use and development of the land. In high-risk flood zones, there may be stricter building codes and floodplain management regulations in place to reduce the risk of damage from flooding. These regulations may limit the types of structures that can be built on the land, or require that structures be built to a certain elevation to reduce the risk of flood damage.

I hope you found this helpful! There are many different types of flood zones, and they aren’t all the same. Hopefully now you understand more about the different flood zones that exist and what they mean for your land investing decisions.

Do you want to start your land buying journey?

Compass Land USA can help you with your land investment! Call or Text us anytime at (313) 349-0434 😊

Are You Looking for More Info?

How You Can Become a Land Buying Expert – Download our FREE Guide here. Or, you can feel free to contact us anytime if you have questions, want to easily and safely buy land, or want to just learn more about how we can help people like you search for land as an investment.

Get the FREE Guide and then give us a call at (313) 349-0434 and we’ll discuss how you can easily buy land with little money using our automatic approval owner financing.

Thanks for sharing

You’re welcome! I’m glad you found it helpful.