Who is responsible for back property taxes? How to find back property taxes? How do you check back property taxes?

I’m going to show you how you can check who for any back taxes or tax liens owing against a property, for free! You can do this search online, or with a phone call. It only takes a few minutes and is one of the most important things you need to check when going through your land-buying checklist.

Want Your Own Step-By-Step Guide of How to Find Out if Taxes Are Owed on a Property?

You can get yourself it for free – just fill out the form below!

Download Your FREE “Find Out if Taxes Are Owed on a Property” Step-by-Step Guide Below

Just put in your name and email, click “Download” and you will have access to the free step-by-step guide right away.

I’m going to share with you the second video in our Due Diligence series, and answer the second question that you should ask when buying land: Are there any back taxes or tax liens owed against the property?

If you have any questions on the content in this post, leave a comment below and I will reply with your answer.

Who is Responsible for Back Property Taxes?

This is definitely a question you want to ask when buying land, probably one of the most important ones. That is because you could be buying a property that has hundreds or even thousands of dollars owing on it, and as the new owner you would be responsible for these debts.

If you want to make sure that you buy your next property debt-free, meaning you happily buy it knowing exactly what the debt situation is, if there are any, you need to check the taxes and tax liens owed against the property.

I am going to use the exact same example property in this series, the one we looked up in the first video to see who the owner was. If you missed that video and want to see how we looked up the property owner information for free – make sure you go check out that first video of our Due Diligence video series.

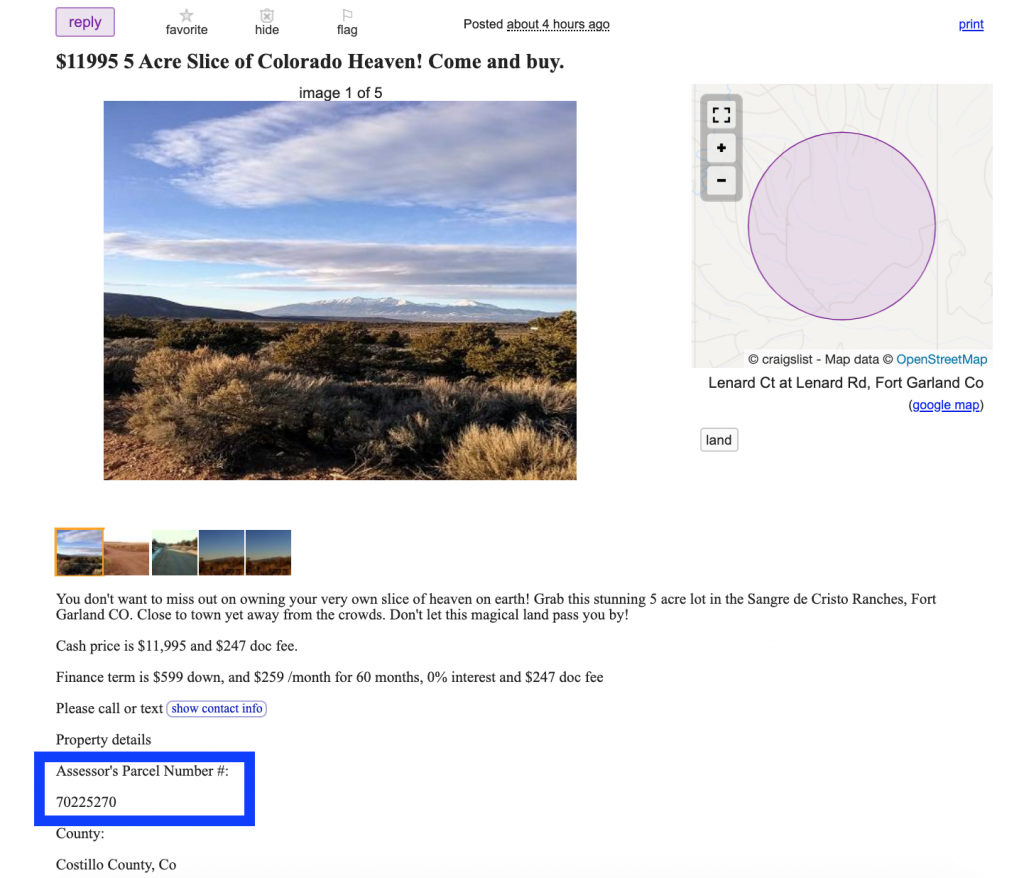

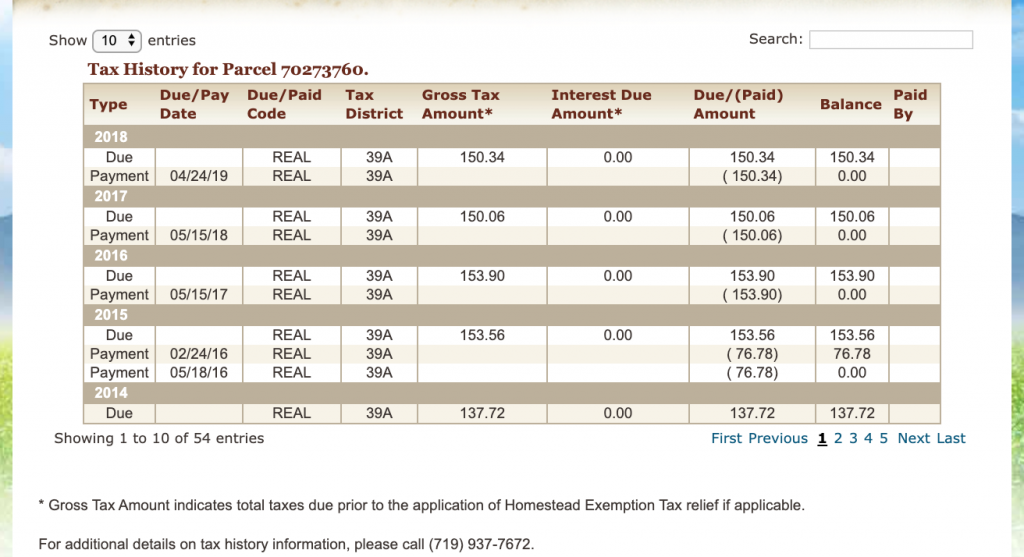

So our example property, is a lot in Costilla County Colorado, with the parcel number of 70273760.

How Do I Find Back Property Taxes?

You will need 2 things to find out the back property taxes and tax liens information for a property.

- You need to know the county that the land is in, so in our case, that is Costilla County.

- You will need the parcel number.

We’re going to start by finding the assessor’s page for the county, and see if they have an online treasurer search.

If you found a piece of property you’re thinking about buying on any of the Land sites, Craigslist, even Facebook Marketplace, you can get the parcel number right from the listing or just ask the seller and they will be able to provide you with that info.

Note: If the seller does not have the parcel number or cannot get it for you – that is a big red flag. It increases the likelihood of that seller being a scam or not having the rights to actually sell you that property.

How to Check Back Property Taxes (for FREE!)?

Okay, now, we need to find the Treasurer’s page for the County, and see if they have an online parcel search.

I’m going to head over to google here and type in ‘Costilla County treasurer parcel search’.

Every county page will be different. You want to look for keywords on the Treasurer’s page such as ‘online parcel search’ or ’treasurer parcel search’. Here is Costilla County’s Treasurer page.

I’m going to click on the link that says ‘Click Here for Online Property Search‘. On the page that follows, you will need to accept the County’s disclaimer.

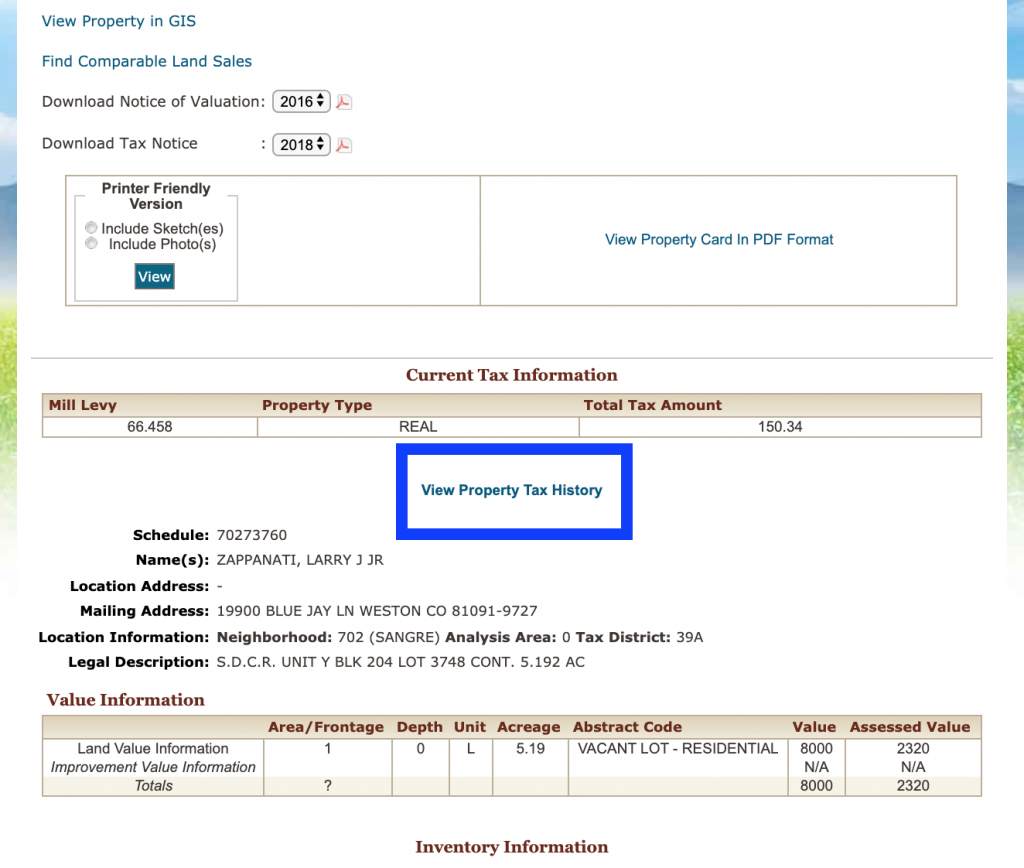

And here is Costilla County’s Treasurer online database. So now you’re going to need that second piece of information – the parcel number (remember for our example the parcel number is 70273760). I’ll paste that in the ‘Parcel Number’ box and click ‘Search for Property’.

Okay so that’s the parcel number we typed in and searched for and here’s our result.

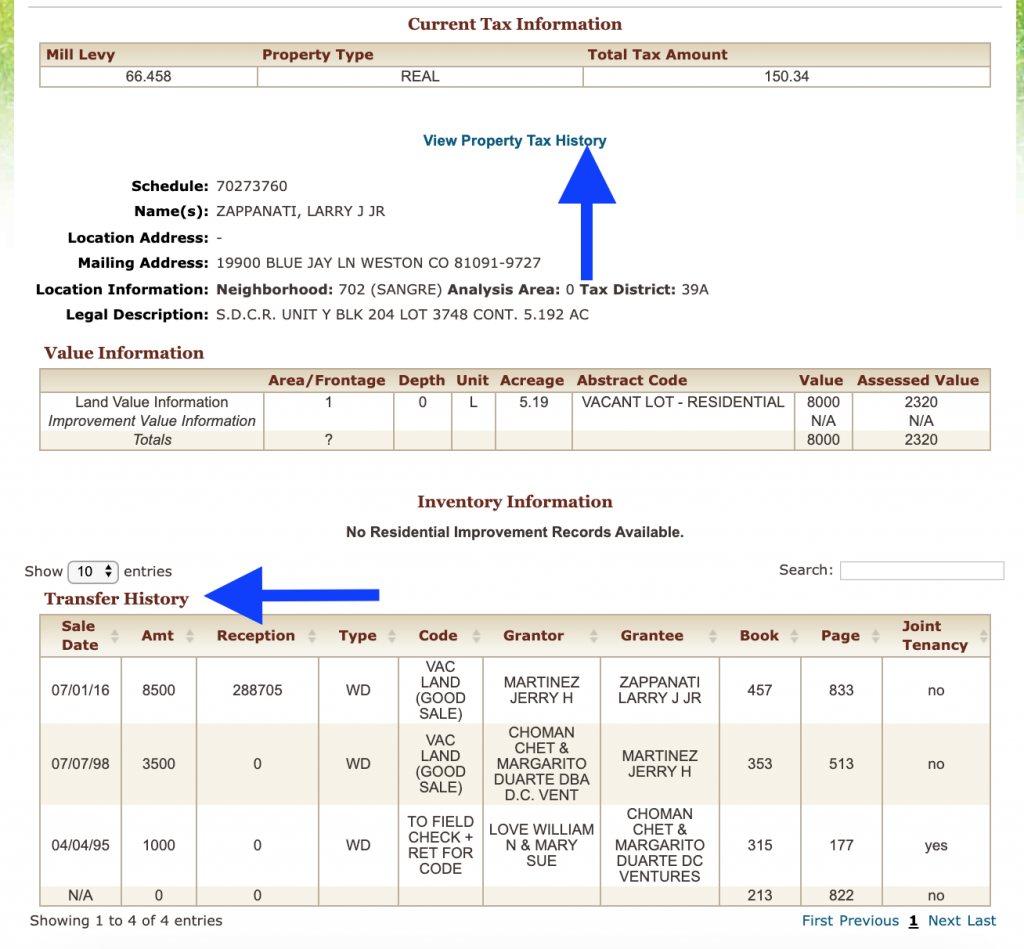

Sometimes the Assessor and Treasurer info will be shared across platforms. So here we can see the owners, same as the owner in our first video and article of the series which is a good thing to note because it means that the county information is consistent.

And a great benefit of Costilla County’s Treasurer database is that you can see the individuals involved in previous transactions (when they bought the property – even how much they paid for it!), detailed owner information, assessment history, tax history, and land details.

Let’s click on ‘View Property Tax History’ and see if it gives us more details.

Okay so it looks like at the time of this writing, this property is up to date on all taxes up to 2018!

I know that this can be a bit confusing to read, and sometimes the online information isn’t the most current.

So what I like to do, and it’s part of our process at Compass Land USA, is to call the Treasurer’s office directly and get all the information on money owing.

You will see at the bottom of the page, ‘For additional details on tax history information, please call (719) 937-7672.’. I would recommend always calling the County to double-check the property taxes, just in case!

If the piece of property you’re looking to buy is in a county that doesn’t have an online database, you can always call the county’s Treasurer’s office and give them the parcel number. They will be able to look up any back taxes and tax liens for you.

What Happens When You Owe Back Property Taxes?

If you found out that the property you are hoping to buy has back property taxes owing on it, and it’s an amount that you are comfortable with and willing to pay, you can usually pay taxes owing to the Treasurer’s office on the phone.

Some Counties will allow you to pay outstanding back property taxes and tax liens online with your debit or credit card. If that is the case, expect to pay a processing fee.

Find Out Back Property Taxes and Tax Lien Information for Free

That is the second step on your Due Diligence checklist, the second question you should ask when buying land – checking what taxes and tax liens are owed. And now you know how to do that for FREE.

The next Due Diligence item on your checklist should be: What is the property zoning? I’m going to go over how to check that in part 3 of this video and blog series.

If you enjoyed this post make sure you like it, share it, tell your friends about it, and don’t forget to subscribe to our YouTube channel so you’re the first to know when the next video in this Due Diligence series is published. By the end of this series, you will have a comprehensive checklist of items you need to check before you buy any piece of land.

If you have any questions leave a comment below I’ll make sure I answer them and help you out. Thank you for reading!

Want Your Own Step-By-Step Guide of How to Find Out if Taxes Are Owed on a Property?

You can get yourself it for free – just fill out the form below!

Download Your FREE “Find Out if Taxes Are Owed on a Property” Step-by-Step Guide Below

Just put in your name and email, click “Download” and you will have access to the free step-by-step guide right away.

The information in this article should not be interpreted as legal advice. I’m not a lawyer, and if you’re considering buying land I recommend getting help from a paralegal or lawyer to find out what your options are. It can be difficult and overwhelming to do a proper Title Search, especially to someone without experience. To be certain of what rights are included with your property, a local title agency or paralegal can help you. Leasing rights and determining access can sometimes escalate into a very difficult and troubling situation, so it’s best to get professional advice.

Good day

1Can you offer Some info on getting an ‘ over the counter’ (old tax lien in inventory- open liens in towns summary ). 2. To get the Deed transferred to me, do l just give the county clerk a FINAL JUDGMENT And the .notice to Discharge the Tax Sales Certificate?

Hi Francene! Thank you for reaching out. You can get ‘over the counter’ data directly from the county. You can either go into the office in person or give the Assessor / IT office a call and see if they can send you a list. There is sometimes a fee for that service.

I’m not quite sure what you mean by a final judgment, but to transfer a property into your name using a deed, you will have to have the seller notarize that deed and then record it with the county. The same applies to tax sales (although in that case the county is the seller and will notarize and record your tax certificate for you). I hope that helps!

I have been trying so hard to find some property that I can buy. It has been so hard to find. I’m looking for delinquent properties. Can you help me. I find properties but after I get the run around.

Hi Tina. Thanks for reaching out! If you’re looking for a list of delinquent properties, you need to go straight to the County. I would give the County’s IT or Assessor’s office a call and ask for a ‘delinquent tax list of real properties’. You might have to pay for this list, expect anywhere from $100-$500.

I hope this helps. Good luck with your search!

I’m trying to find out if my Grand-daddy has any more back taxes on land. Please help.

Hi Hope! You will need to get the parcel number / AON from your grandfather, and then contact the County treasurer’s office to see what the tax or debt situation is. Hope this helps!

Hello, what is a parcel number and how do I get that information to check if taxes are owed on a property?

Hi Daysy! A parcel number (or APN) is a unique identifier created for the property by the County’s Assessor office. This helps county staff, and you, communicate and make sure you’re both referring to the same property. To find the APN you can call the county directly if you know the address of the property or are the current property owner. You can also try locating the property in the county’s online mapping system (if they have one). Hope that helps!

Do I currently owe taxes on my property?

Hi Pamela. You can use the steps mentioned above in this article to find out.